A Crash Course — Quartz Weekly Obsession — Quartz

go for gold

As a commodity, gold has had what one analyst this summer called “a manic roller coaster ride.” It hit an all-time high in the summer of 2020 as global covid cases surged, topping $2,000 an ounce. Since then, it has fallen sharply, although prices recently soared above $1,700 amid turmoil in the crypto world and a falling dollar.

The precious metal has traditionally been considered a safe haven in times of volatility, uncertainty and distress – and the world has certainly absorbed a mind-blowing cocktail of all three in the past two years between the ongoing pandemic, the invasion of the Ukraine by Russia and the ensuing global energy crisis.

But aggressive rate hikes by the US Federal Reserve as it battles inflation have fueled a relentless rise in the dollar, which in turn has drowned out the sails of gold. This is partly because yields on 10-year U.S. Treasuries, which compete with gold as a safe haven, are at their highest level since 2008.

“All these trillions of dollars that we’ve printed over the last two years… I think the money is coming back to haunt us,” said Michael Townsend, director of Infinity Stone Ventures, a Canadian company that mines critical metals. , including gold. “I think inflation is here to stay…so gold is here to stay.”

Let’s continue to pan.

Mapped

golden rollercoaster

Image copyright: Mary Hui

By the numbers

6 grams: Weight of pure gold in an Olympic gold medal

31.103 grams: The equivalent of one troy ounce (ozt) of gold, a measurement used for precious metals

20.37%: Share of world gold reserves in Australia in 2021, more than any other country

8%: Gold prices rally after UK Brexit vote in 2016

18: Carats in a solid gold toilet the Guggenheim Museum offered to loan to the Trump White House

$35 per ounce: Value of gold according to the Bretton Woods system, in force from 1958 to 1971

Brief history

The birth, death and reincarnation of the gold standard?

In July 1944, 44 countries met in Bretton Woods, New Hampshire, to develop a plan for the future of the international monetary system after World War II. This plan finally came into effect more than a dozen years later, in 1958. Under the Bretton Woods system, countries pegged their currencies to the dollar, which in turn was pegged to gold at $35 an ounce.

“In effect, the entire Western financial system was pegged to gold, via the dollar,” as John Authers of Bloomberg describes it. And with the United States holding about three-quarters of the world’s gold reserves, the system seemed secure.

But a gold-dollar crisis was brewing. Gold was moving out of the United States, due to America’s declining share of world production as European and Japanese exports became more competitive, but also due to military spending and foreign aid from United States. Then, in 1965, came the Great Inflation in the United States, threatening a run on American gold reserves. To ward off this risk, then-President Richard Nixon abolished the convertibility of the dollar into gold in 1971.

Could the gold standard return? This question has periodically surfaced in public policy discourse, although most economists dismiss the possibility as a wild ride.

More recently, however, the global energy and food price crisis caused by the Russian invasion of Ukraine has revived interest in a new kind of Bretton Woods system, with commodity-backed currencies raw. Think of metals, grains and energy.

Quotable

“Turns out our sewage contains a crap of gold (pun intended).”

— Georgia Hepburn, The University of Melbourne

According to research, sewage can contain many precious metals, including gold, from a variety of sources, including the dental industry, vehicle exhaust, and jewelry abrasion.

Bonus Table

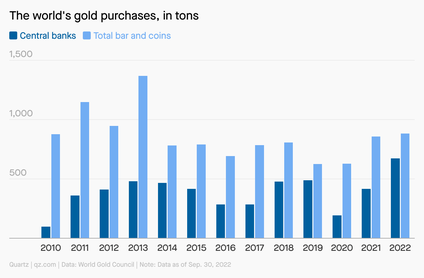

Image copyright: Mary Hui

Central banks around the world are snapping up gold at a rate not seen since 1967, when the dollar was still backed by the precious metal. An inflation-fueled flight to safe assets has driven much of the increase in demand.

Turkey was the biggest buyer of gold in the third quarter, followed by Uzbekistan (26.13 tons) and India (17.46 tons), according to the World Gold Council, although not all countries do not regularly declare their purchases.

Image copyright: Lintao Zhang

Flash Quiz

What is the chemical symbol for the element gold?

- At

- God

- Ru

- 🥇

Find the answer below!

take me that 🐰 hole!

Would you rather have a golden parachute, a golden handshake or a pair of golden handcuffs?

Brian Klaas, professor of global politics at University College London, argues that golden handcuffs – the offer of a comfortable life in exile – can be a solution to persuade autocrats to leave power (however, he does guard, this option should not be made available for the worst of the worst, including Vladimir Putin).

Several dictators gladly accepted the offer of gold handcuffs, according to Klaas.

In 1994, US officials reportedly offered Raoul Cédras, Haiti’s military dictator, a $1 million exit package in exchange for leaving power without a fight.

And in 2016, a bloc of West African countries told Gambian dictator Yahya Jammeh, who refused to concede electoral defeat, that he could either face an invasion or go into exile. Jammeh chose the latter, fleeing the country, but not before allegedly looting millions of dollars from state coffers.

Klaas further explains why such golden handcuffs might be a realistic option to reduce the number of autocrats in the world:

“Some might argue that the golden handcuff option would create moral hazard, encouraging dictators to believe they will never be brought to justice for their crimes,” Klaas writes. “But most dictators escape justice anyway, dying of old age, or at the hands of a rival or an angry mob. A safe passage policy would more likely increase the transitions of dictators who would otherwise , would have fought to the end to stay in power, rather than diminishing the amount of justice served.

Image copyright: Johannes Eisele

Survey

Should dictators and autocrats be given golden handcuffs?

- Yes, this is a realistic option

- No, it’s a minefield of moral hazard

- Yes, but real gold handcuffs

We command you to participate!

💬 Let’s talk about it!

In last week’s poll on Adam Smith’s Invisible Hand, 51% of you wish that an invisible hand could help clean your house, 34% of you doubt an invisible hand in this economy, and 15% of you are hopefully recovered from your visible headaches.

Only a few of you have correctly identified the event shown in the table. The marker was the day when, in the wake of the stock market crash, the US Congress initially voted against a financial rescue bill, in part due to Republican opposition to intervening in the market. In other words, the visible hand of government could have really helped!

🤔 What did you think of today’s email?

💡 What should we be obsessed with next?

Today’s email was written by Mary Hui (still looking for chocolate bars for his golden ticket), and edited by Susan Howson (favorite ABBA Gold) and Samanth Subramanian (and his golden conscience).

The correct answer to the quiz is A.Au, but the periodic table will surely switch to emoji in our lifetime.