Bitcoin sells as regulatory concerns resurface

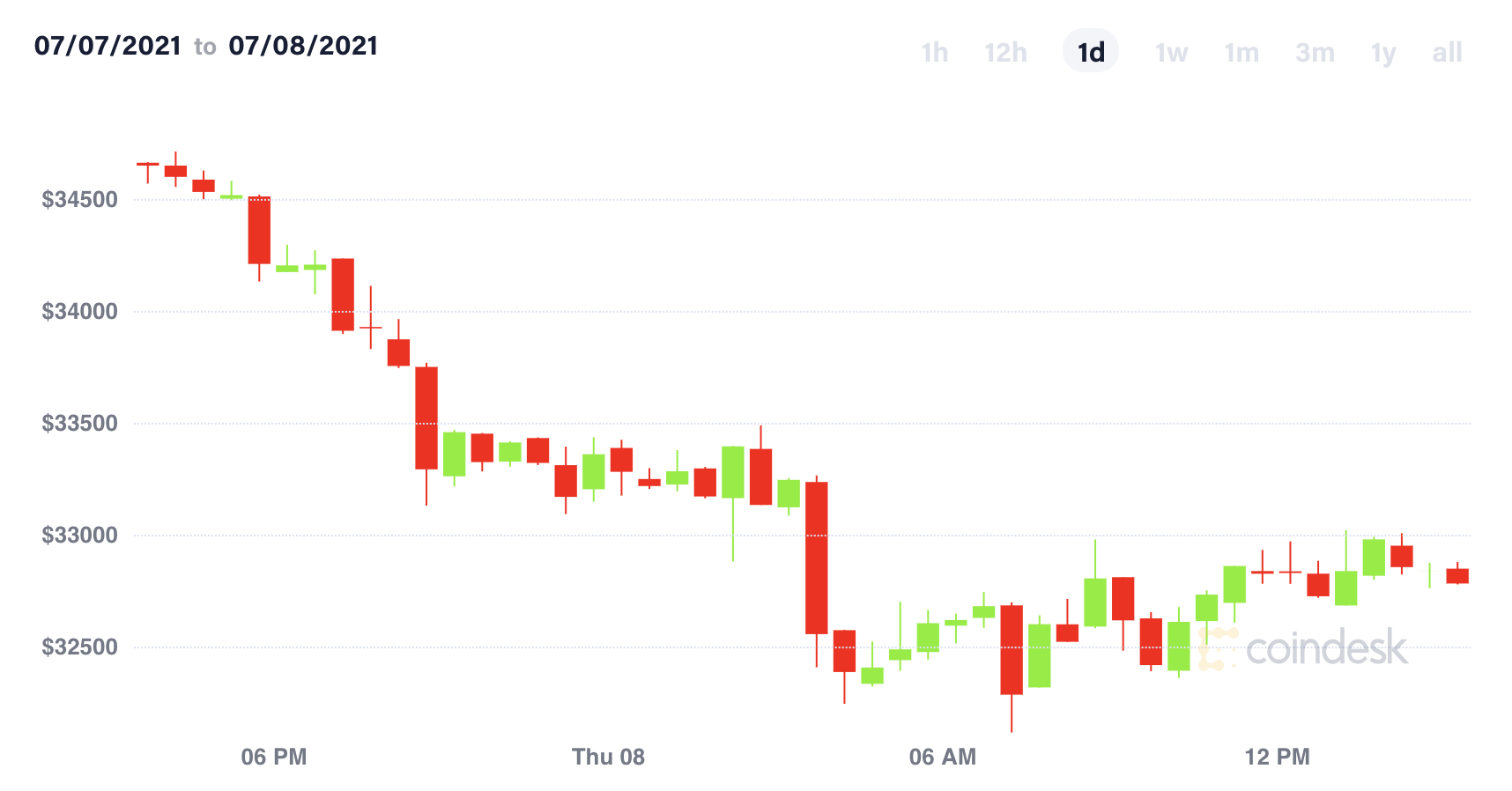

Cryptocurrencies traded lower on Thursday as regulatory concerns resurfaced. Bitcoin has moved below initial support at $ 34,000 and is down around 5% in the past 24 hours. The cryptocurrency could stabilize around $ 30,000, which is the low end of the one-month trading range.

There is a lack of “real catalyst or market development events right now,” wrote QCP Capital in a Telegram chat. “We expect volatility to remain under pressure until mid [to] end of August.

“With BTC, we have seen some funds speculate that the lack of storytelling combined with lower levels of liquidity on the exchanges can cause prices to rise if a positive headline is to occur,” wrote Chris Dick, quantitative trader of crypto trading company B2C2.

Latest prices

Related: First division of Midwest Bank Trust holding 29.5,000 shares of Grayscale Bitcoin Trust

Crypto-currencies:

Bitcoin (BTC) $ 32,962.45, -4.68%

Ether (ETH) $ 2157.6, -8.93%

Traditional markets:

S&P; 500: 4,321.07, -0.85%

Gold: $ 1,801.8, -0.11%

The 10-year Treasury yield closed at 1.3%, down from 1.318% on Wednesday

Regulatory headwinds

Growing concerns from regulators have weighed on cryptocurrency prices in recent months. This week, China’s crackdown intensified when the country’s central bank issued a warning about the risks of stablecoins.

“Global stablecoins can pose risks and challenges for the international monetary system”, mentionned Fan Yifei, vice-governor of the People’s Bank of China (PBOC) Thursday. The banker also said the central bank is already taking action against cryptos.

Related: Regulators everywhere should follow Wyoming DAO law

In Europe, several countries are to propose form a new agency to crack down on cryptocurrencies that could potentially be used for money laundering. The concerns also include the financing of terrorism and organized crime, which should be addressed at the European Union level, according to documents reviewed by Reuters on Thursday.

The risks associated with cryptocurrencies were also examined by 15 West African nations in parliamentary meetings Thursday.

And in the United States, Senator Elizabeth Warren (D-Mass.) Gave the Securities and Exchange Commission (SEC) until the end of this month to understand its role in the regulation of cryptocurrencies.

Grayscale reset

Some analysts are not convinced that bitcoin could receive a boost from the expiry investor restrictions on the sale of shares of Grayscale Bitcoin Trust (GBTC), the world’s largest cryptocurrency fund. (Grayscale is a unit of Digital Currency Group, of which CoinDesk is an independent subsidiary).

“We don’t expect these unlocks [their] clean to have a significant impact on the overall market outside of GBTC itself, ”QCP Capital wrote in a Telegram conversation.

“Most of the large institutional positions that had subscribed in kind before have already been released earlier, and they have suspended the sale at the current reduced price.”

Flows shift from stablecoin cash to crypto

The stablecoin supply ratio (SSR), which measures the relationship between bitcoin supply and stablecoin supply, stabilizes after a sharp decline from the January peak.

“A low SSR involves large amounts of stablecoins at the margin – or more purchasing power to buy risky digital assets,” wrote David Grider, strategist at Fundstrat, in a Thursday bulletin.

The SSR shows that flows have shifted from bitcoin to stablecoins for most of the year, but have recently hit a low. This could indicate investor confidence in the price direction of bitcoin while stable money is being used.

Circle to become public

Circle, operator of USD coin, the second largest stablecoin in the world, announced that it is SEO on the New York Stock Exchange through an acquisition by Concord, a ad hoc acquisition company, or SPAC, led in part by former Barclays CEO Bob Diamond. The deal values the crypto financial services company at $ 4.5 billion.

The Boston-based firm generates income in three ways, according to its presentation to investors: transaction fees on USDC and interest earned on its reserves; transaction and treasury services (TTS); and SeedInvest, the crowdfunding platform it bought in 2019.

Jeremy Allaire, CEO of Circle, wrote in a tweet that turning a private company into a public company “creates an opportunity for Circle to also provide much more transparency on the activities we are building around USDC and on the reserves that support the USDC. “

USDC has reached approximately $ 25 billion in stock from less than $ 1 billion a year ago, as a growing number of investors have required more information on the assets supporting the stable coins.

Altcoin balance sheet

Circle losses due to email fraud: Circle lost more than $ 156 million on its successful buyout and subsequent airdrop from crypto exchange Poloniex, the payments company revealed on Thursday. The company also lost An additional $ 2 million to email scammers in an “incident” that occurred last month.

Terrorists hold cryptos: Israeli officials have moved potentially seize millions of dollars in cryptocurrency from addresses he says are Hamas-controlled. The wallets, 84 in total, contain a mix of cryptocurrencies, including BTC, DOGE , ADA , XLM , XRP, ETH and others.

Relevant news

Bank of America Creates Dedicated Crypto Research Team

Can Taiwan Become Asia’s Crypto Heaven? Not yet

Elizabeth Warren Gives SEC July 28 Deadline to Understand Crypto Regulations

Other markets

All digital assets on CoinDesk 20 ended lower on Thursday.

Notable losers at 9:00 p.m. UTC (4:00 p.m. ET):

spotted (DOT) -11.25%

the graphic (GRT) -9.9%

uniswap (UNI) -9.01%