Copper Mountain 2020 Life of Mine Plan: Investment Implications

SimoneN

Unless otherwise specified, all monetary amounts listed below are in Canadian dollars.

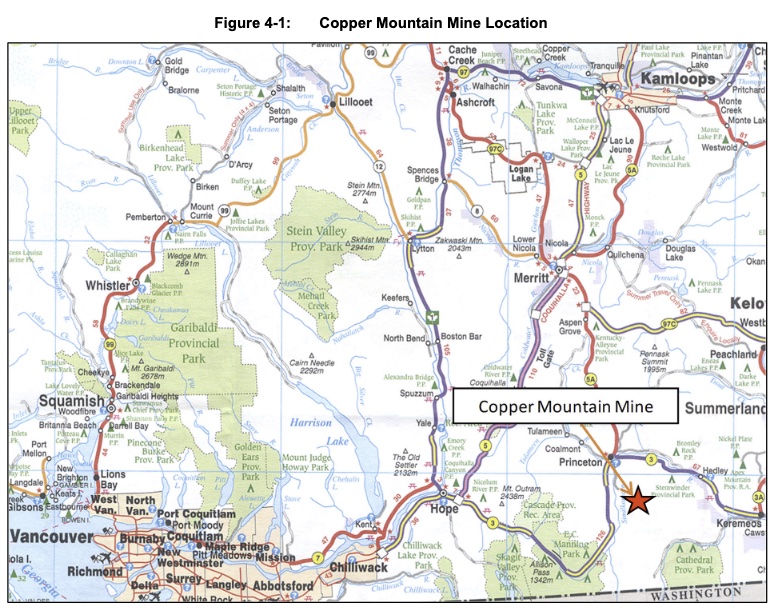

My recent article on Copper Mountain Mining Corporation (TSX:CMMC:CA) and (OTCPK: CPPMF) explored the company’s operations in detail. This analysis was based primarily on quarterly and annual Sedar filings, plus some drawn from other sources. The article also talked about the copper market, a subject on which I have nothing more to say here.

The article’s conclusion was that CMMC shares appeared to be undervalued, based on standard ratios. It also seems undervalued compared to other copper mining companies.

Further interactions with members of Michael Boyd’s Energy Investment Authority made me realize two things. There were weaknesses in my analysis, and there was an opportunity to improve it.

Both of these questions are addressed here by working with data from the Life of Mine Plan published in 2020, hereafter referred to as “The Plan”. It is available on sedar.com in the form of a technical report.

My goal here is to share better analysis based on this more complete information. The conclusion of the works is that Copper Mountain is a better investment than I thought. This led me to create a post recently.

Consider management

Some readers of my previous article claimed that Taseko (TGB) (TSE: TKO) in particular is a superior company and that in comparison CMMC has poor management. There’s a lot to like about Taseko and at a certain price I’d find it appealing.

But CMMC is the one whose stock is much more suppressed in price this year, compared to last year. The previous article discussed some reasons for this, but inherent mismanagement was not one of them.

Taseko operates a mountain, Gibraltar, which is remarkably similar to Copper Mountain in terms of overall grade and recoverable ore.

If you read Taseko’s early statements regarding Gibraltar, they are strikingly similar to those of Copper Mountain a few years later. They exhibit a long streak of delays in getting the grind volume where they wanted it.

Yet these commentators felt it was obvious that Copper Mountain was bad at mine management while Taseko was good at it. I have not found any objective evidence to support such claims.

Mining is difficult. Murphy is active there.

A mountain of copper

Copper Mountain itself has a very long history. It’s also a great illustration of the truth that you never run out of a resource; it just gets more expensive to recover.

CMMC 2020 Life of Mine Plan

In the geology of this mountain, copper comes with gold and silver. I discussed accounting for these in the previous article and say no more here. The focus of the analysis here and here is on earnings per pound of copper produced.

Underground mining began in 1922. Between 1927 and 1957, Granby mined 31.5 Mt of ore at a calculated grade of 1.08% copper. The quality of the copper went down from there.

Newmont Mining Corporation began open pit operations in 1972. The initial reserve was 69 Mt at a grade of 0.53%.

Mining was shut down for a decade in 1996. Copper Mountain Mining Corporation purchased the mine in 2006 and began its current phase.

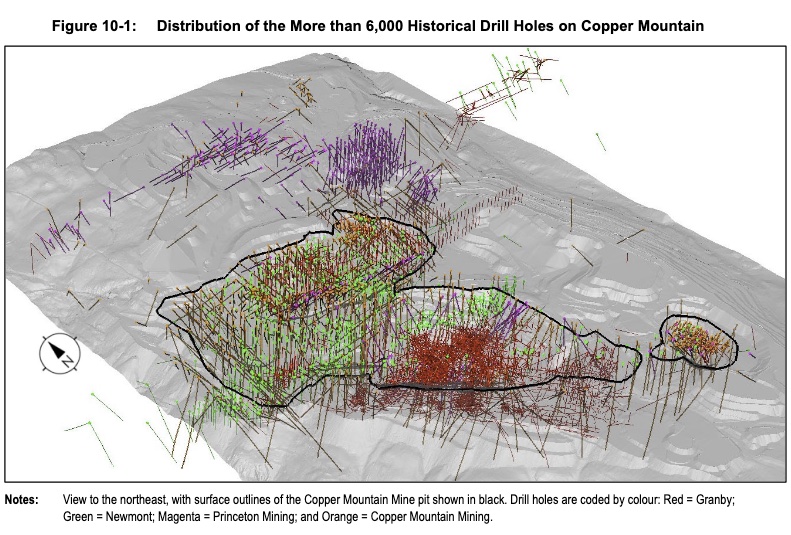

As of 2020, the understanding of the mountain was based on numerous measurements. Among them, 7,717 exploration holes have been drilled since 1917.

Most of the holes date from the 1950s to the 1970s. CMMC drilled 1,087 holes from 2007 to 2020. The holes in total are shown here.

CMMC 2020 Life of Mine Plan

The plan addresses many other aspects of mine characterization. Copper Mountain is relatively well understood, so the mine plan appears to be based on fairly solid data. The contrast to what we see from oil and gas companies is notable.

The average copper grade of the Life Of Mine 2020 plan is 0.23%, less than half that of the Newmont era. Total proven and probable (2P) reserves are 462 MT.

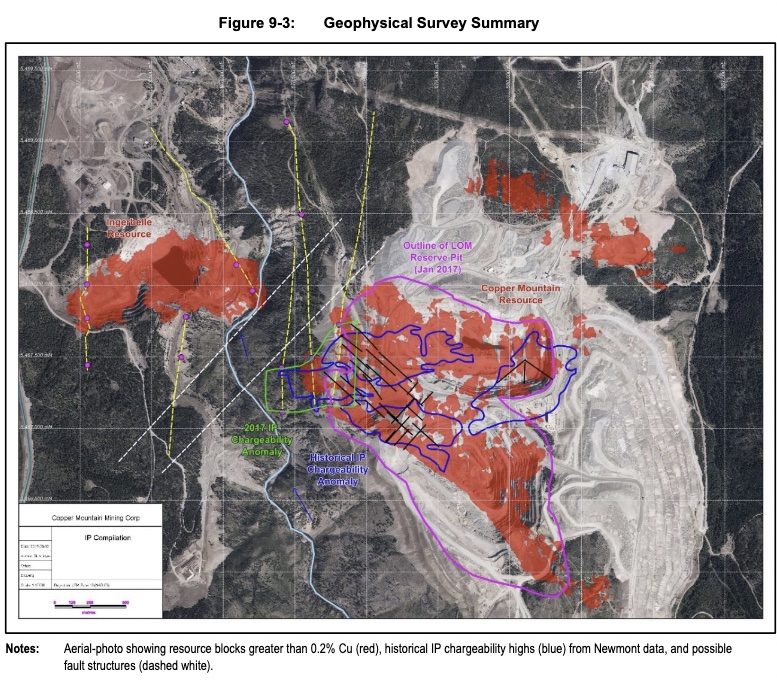

Here is the summary of the current findings of the geophysical surveys. CMMC drilled 250 holes in the area to the left known as New Ingerbelle. These expanded the mountain’s economically viable reserves.

CMMC 2020 Life of Mine Plan

With further exploration, the number of 2Ps continued to increase. The ratings below are based on the 2020 Plan. There will be a 2022 plan later this year.

Plan Features

The plan set out, year by year, the amount of milling that would take place, the amount of ore that would be ground, its grade, and the amount of mining that would be required to supply that ore to the mill.

Notably, the plan assumed that milling would operate at 45 ktpd in 2022 and 2023 and 65 ktpd thereafter. CMMC will not achieve this rate of 45 ktpd in 2022, for the reasons discussed in the previous article, but is on track to do so soon.

They have a chance to stick to the plan after that. More likely, various events will slow things down and it will end up taking a few years longer than expected to come to the end of planned mining (if they stick to the 2020 plan). The implications of this will be small potatoes in the context of the evaluation results below.

In return, CMMC is talking about moving to 100 ktpd of grinding. If they succeed, a large portion of future production will show up, so its net present value, or NPV, will increase.

As you’ll see, however, precise results aren’t the point here. We want a large margin of safety for a resource extraction investment.

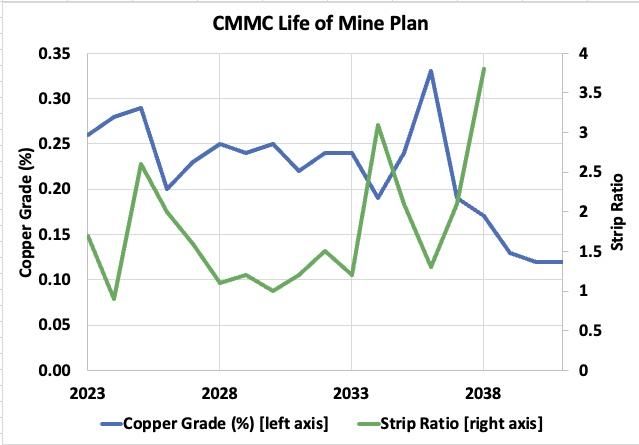

Based on the mountain data, the plan shows the expected copper ore grade and Strip Ratio. (The stripping ratio is the ratio of total tonnes mined to ore mined.)

RP Drake

We see that ore grade will generally be below 0.25%, with some periods when it will be higher. I had misinterpreted some things I had read, so the previous article predicted a higher rating.

The Strip Ratio is usually around 3x but varies. This curve (green) ends after 2038, when all that remains is to grind the remaining, previously stockpiled low-grade ore.

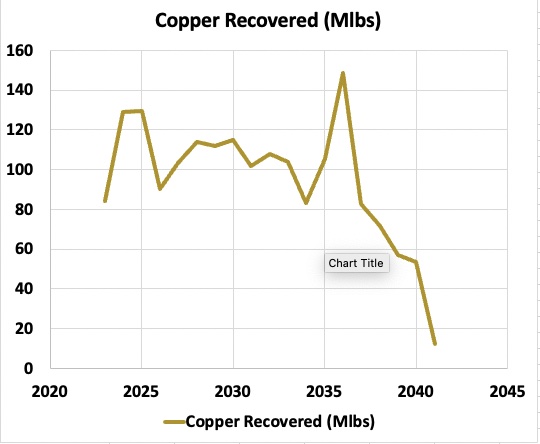

The Plan includes modeled recovery rates, which vary by year, but are always between 80% and 90%. The resulting weight of recovered copper averages around 100 million pounds per year through the late 2030s.

RP Drake

Costs and Benefits

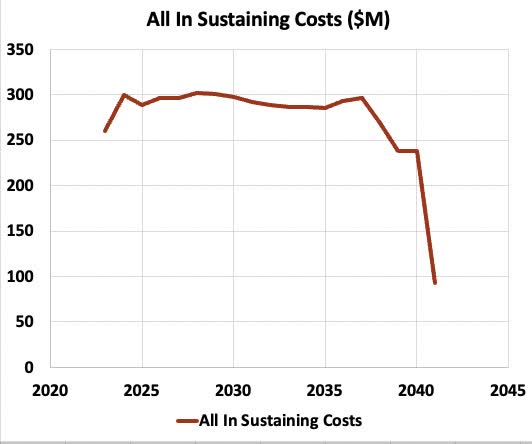

My estimate of the total 2023 costs (roughly what CMMC calls all-in sustaining costs) from the previous article was $260 million, including $210 million for mining and milling. In order to scale them, a model was needed for the division between mining costs and machining costs.

I used numbers found in the 8th edition of Wills’ Mineral Processing Technology for surface copper mining. The total cost in 2023 was attributed 38% to mining (for $80M) and 62% to milling (for $130M). These numbers have been scaled over time based on changes in mining or milling volumes.

Admittedly, the precise cost ratio varies by year and may even be different on average for that mine. But what matters here is that machining is a bit more expensive than mining and the ratio is closer to 2/1 than 5/1 or 10/1. Here is the resulting estimate of direct mining and milling costs per year.

RP Drake

That’s in 2023 dollars. These costs increase to about $300 million a year as volumes machined increase. They remain at roughly this level until the late 2030s.

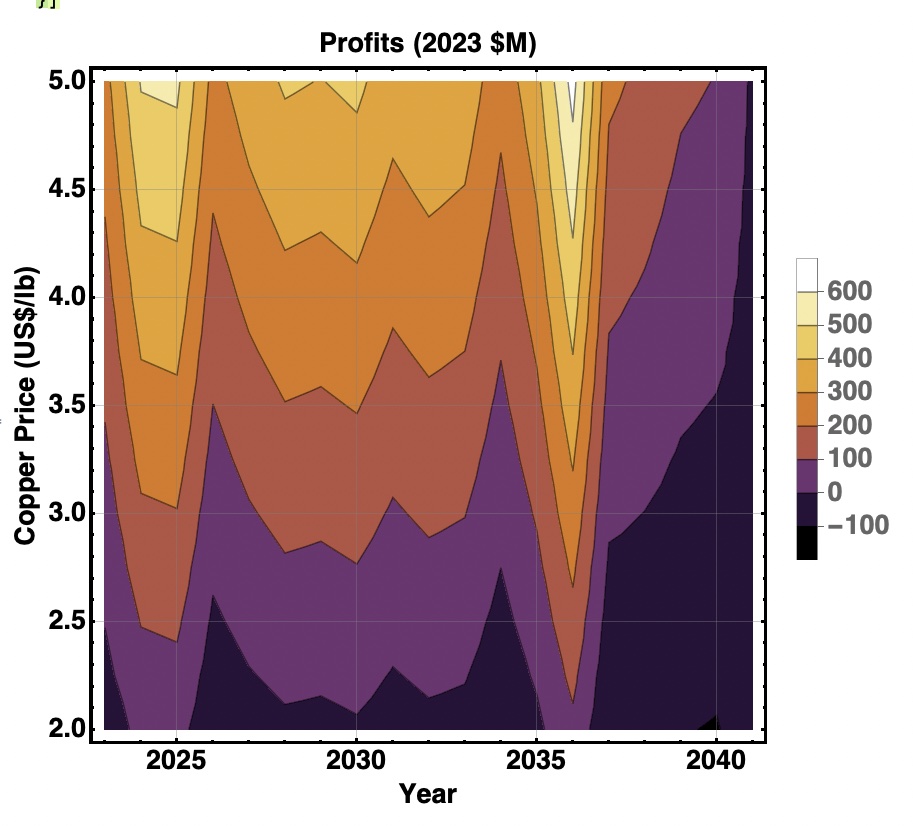

Based on the above data and an assumed copper price, one can determine the annual profits on copper sales. This is copper revenue less all-in sustaining costs, as shown in the previous article. These are displayed here graphically for copper prices ranging from $2.00 per pound to $5.00 per pound.

RP Drake

Here there are two vertical bands, corresponding to increased profits in the years when the higher grade ore is mined. Copper prices of US$3.50/lb generate profits of nearly $200 million per year. Copper prices near US$2.00/lb generate losses almost every year.

Net present value and valuation

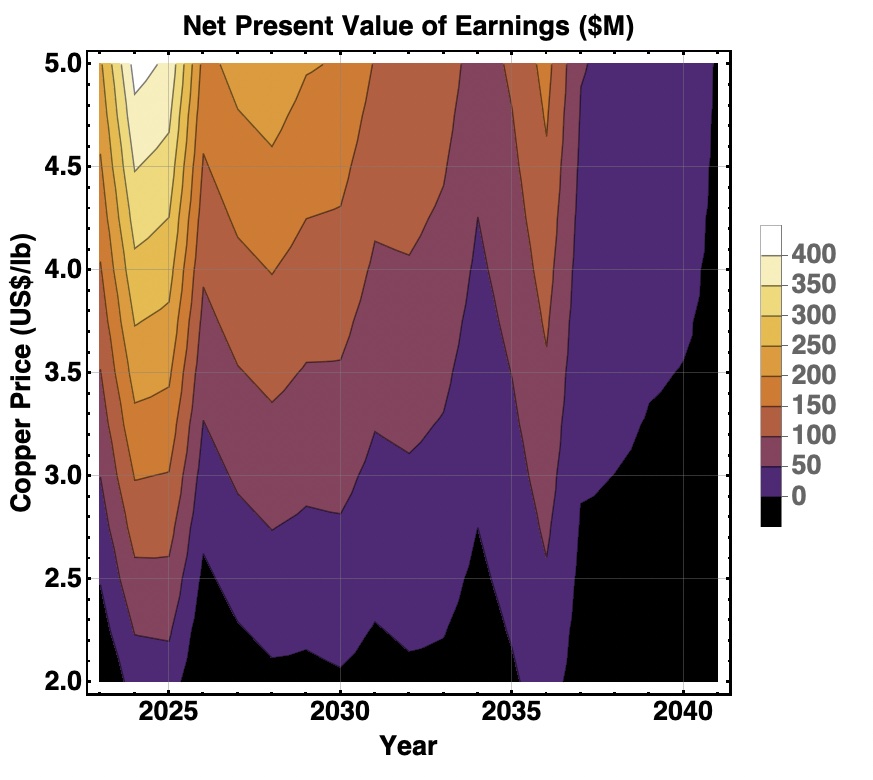

We can take the data just displayed and assume a discount rate to find the NPV of earnings in any year, for any price of copper. Here is what we get for a 10% reduction rate:

RP Drake

We see, as expected, that the last few years are pushed down in value. In particular, this rich ore, which is scheduled to be mined in 2036, has a much lower relative NPV.

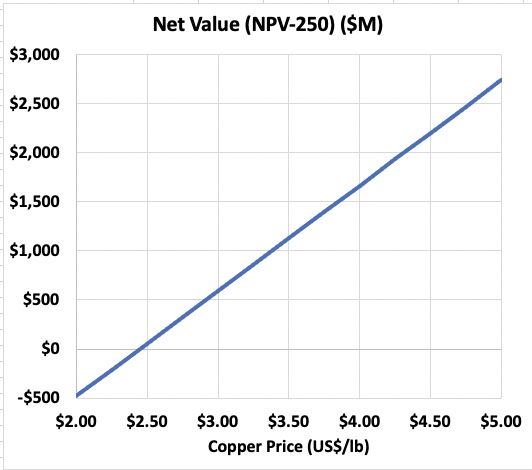

We can get an overall net worth for CMMC for a given copper price and discount rate by adding the values shown on the last graph for that price and then subtracting the net debt from $250 million. This produces the following plot:

RP Drake

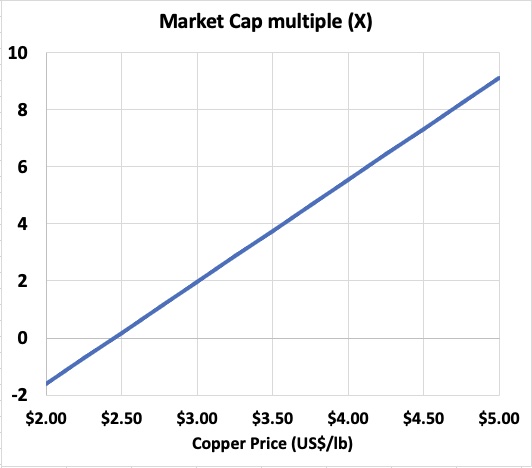

We find that for copper prices above $3.50, net worth exceeds $1 billion. By dividing this by the current market capitalization, taken to be $300 million, we find the multiple by which the stock price would need to increase to reach its fair value. It’s shown here:

RP Drake

This is the bottom line. If you consider it reasonably likely that copper prices will languish below US$2.50 per pound for an extended period, then CMMC is not for you.

On the other hand, if your view of the copper market is similar to mine, then you see the current mid-cycle price near US$3.50. You also see that it is likely to remain overall or increase over time through increased demand.

Under these assumptions, CMMC is undervalued by a very substantial amount. Increasing the discount rate does not reduce the multiple enough to make a big difference. There’s enough headroom here for me to establish a position.

My previous article discussed some reasons for the relative decline in the price of CMMC shares. I want to emphasize that investing there is a decision on my part to invest in a company that turns out to be significantly undervalued in two ways: relative to its peers and relative to fundamental value.

My investment does not reflect a decision to invest for the long term or to fall in love with the business. As a friend of mine on High Yield Landlord often says, “Love your family, not your stocks.”