Magnetite Mines Boosts Razorback Momentum with PFS Plan

Magnetite Mines has released its long-awaited pre-feasibility study for its Razorback iron ore project in South Australia, as it moves towards a DFS project and a 2024 production target.

The eagerly awaited study of Magnetite (ASX: MGT) in its flagship project is ideally placed against a backdrop of high demand and subsequent high prices for the steelmaking material, and the PFS economy does not disappoint.

The study confirms the desirability of accelerating the long-term, high-yielding development of the large-scale resource at Razorback, using a stepwise approach to produce an attractive, high-quality concentrate.

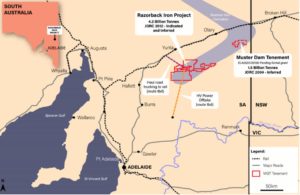

Compared with many new iron ore projects that require significant outlay from the start, the initial capital intensity at Razorback is relatively low, enabled by the use of existing infrastructure in the South Australia region which allows society to quickly gain the status of producer.

In a climate where projects of a similar scale can be crippled but a lack of access to funds, the ability to go into production at a realistic cost makes a significant difference in Magnetite’s ability to start up and operate quickly and reliably – allowing a production target of 2024.

The PFS Razorback describes a project with an initial capital investment of $ 429-506 million, resulting in optimized case outcomes including a net present value of $ 669 million and an internal rate of return of 20% over in the event of the future selected long run average prices for iron ore – one of the many economic options explored by Magnetite. Current prices are almost double the level used to generate these results.

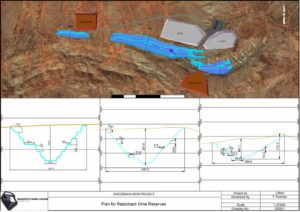

The case selected by Magnetite – known as the overhead grade improvement case (HGIC) – is based on higher extraction rates than the PFS benchmark case, with an upgrade in the overhead grade. head from selective extraction or sorting of ore. It would produce 2.7 million tonnes per year of high grade concentrate over an initial mine life of 23 years.

An optimized three-stage 15.5 Mtpa plant would be built to generate the concentrate, using three stages of grinding and three stages of magnetic separation and flotation to obtain a premium magnetite concentrate from 67.5 to 68.5 % of iron.

Reliable, low-cost energy is provided through connection to the South East Australia power grid, which operates with a progressively renewable supply mix, giving it a decreasing emissions profile.

In an investment climate where the emphasis is increasingly on the environmental, social and corporate governance (ESG) principles of a project, having access to an existing and reliable source of energy with a presence Growing renewable is a significant advantage in financing.

The company will not need to build its own power generation infrastructure, contributing to the low investments described in the PFS, while the use of renewables by the grid is linked to Magentite’s commitment to build a project and organization focused on sustainability.

Existing transport networks would also be exploited.

It is important to note that once built the project would continue to generate returns after all costs and sustaining capital at a floor price as low as $ 54 / cost and a ton of freight at an iron base of 62. %.

This type of price trough would generate significant returns for Magnetite shareholders compared to current iron ore prices of + US $ 200.

Prices for 62% iron ore fines have averaged US $ 98 / t over the past decade, adjusted for the US CPI at a real index of US $ 110.

Additionally, Magnetite’s intention to produce a high quality concentrate should receive a significant premium over the fine price of 62%. Higher iron content is beneficial to steelmakers, and over the past year the 65% fines product has sold for US $ 19 / t higher at 62% fines. The same measure stands at US $ 15 / t for the past three years.

With MGT targeting high grade concentrate production in the 67.5% to 68.5% iron range, the realized price for this high grade product is expected to be even higher.

All options explored

The PFS once again underlines the rigorous and methodical work that the company has put into advancing its iron ore project and its enormous potential for many years.

Magnetite Technical Director Mark Eames said Storer that for the PFS, the company carefully considered its options for each stage of the project before settling on the HGIC.

“For the processing plant, we looked at different scales while for the processing scheme, we looked at different grinding and separation technologies,” he noted.

“We did a very detailed metallurgical sampling analysis to make sure we had a good understanding of the resource and we compared the costs to those of third parties. “

The Future Case has a nominal mine life based on current ore reserves of over 20 years, with substantial potential to extend or extend that life through further resource conversion.

“This small-scale start-up enables the practical development of a long-lasting, high-quality business with a target date for the first ore to be shipped at the end of 2024,” CEO Peter Schubert noted in the press release. PFS.

PFS improvements

Eames said the Magnetite team strongly believes in the benefits of selective mining and sorting of ore and this is reflected in the decision to come forward with the HGIC.

“Increasing the mill head grade gives us a higher throughput for a similar footprint, resulting in increased production and cost savings in processing. he said.

Highlighting the conservative nature of Magnetite’s estimates, Eames said the company took direct capital estimates from its world-class consultants and added 15% for engineering and construction costs for its construction.

“We then put in an additional 23% to make sure we had the right contingency,” he said.

Razorback iron ore growth potential

While the numbers shown in the future case for Razorback represent a significant improvement over the scoping study assumptions, there is potential for further optimization.

The above figures are measured against a 62% fine iron ore price of US $ 110 / t. But given that the price of 62% iron ore fines averaged around USD 184 CFRt in the six months to the end of July, the company also estimated the after-tax NPV and IRR. at $ 1,544 million and 33% respectively using a higher price of $ 150 / t price.

The cash flow in this case is $ 237 million per year.

The project is also based on the current reserve of 472.7 million, or approximately 68.5 Mt of 67.5% iron ore concentrate at a mass recovery of 14.5%, which represents only 31% of the global indicated resource of 1.5 billion tonnes and 16% of the global resource – a small share of a huge iron pie.

Razorback’s existing mineral resources do not contain any of the Muster Dam housing packages awarded to Magnetite by the South Australian Department of Energy and Mines in March.

This building, about 110 km northeast of Razorback, has an inferred resource of 1.5 billion tonnes in its own right.

This means that with further assessment, the company can easily convert more of its resources into reserves that could extend mine life or fuel expansion.

The scale of the plant in the study was also limited to ensure that capital costs were kept manageable, and the mine life was capped at 30 years, leaving considerable potential for the future.

This article was developed in conjunction with Magnetite Mines, a Stockhead advertiser at the time of publication.

This article does not constitute advice on financial products. You should consider getting independent advice before making any financial decisions.