More high-grade gold hits near surface provide larger PNX footprint in NT

High-grade drilling results closer to the surface of PNX Metals’ Glencoe gold deposit significantly increased the prospective footprint of the Northern Territory project, with further drilling underway.

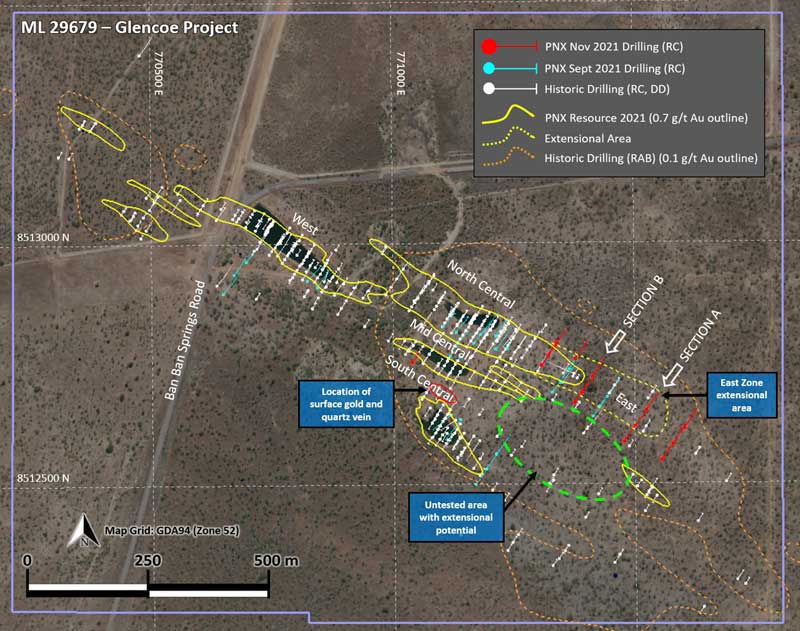

PNX Metals (ASX: PNX) drilling extended direction an additional 80m east of the September campaign, with fill holes intersecting several areas of thicker gold mineralization near the surface outside the resource existing.

The latest program also demonstrated excellent longitudinal continuity over at least 450m from the historic North Central Pit and identified four main gold rich zones.

Mineralization was intersected up to 2 m from surface.

The best result came from the mid-central zone, where a hole confirmed the extension of a narrow zone of high-grade gold by cutting 2m at 6.8 grams per tonne (g / t) from 28 m, including 1 m at 10.93 g / t, only 20m from the previous borehole.

Other notable intersections were 6 m at 1.65 g / t gold from 13 m; 12m at 1.39g / t from 45m, including 3m at 2.2g / t from 69m; and 5m at 2.15g / t from 68m.

The results follow a very successful first drilling program which extended the strike by more than 200 m to the southeast of the current resource. Near surface rock chips of up to 6.02 g / t were also reported in this area last month.

“We are delighted to see further high grade interceptions near the surface and to extend the direction of the Glencoe gold deposit to more than 200 meters beyond current mineral resources,” said General Manager James Fox.

“We continue to scale up the deposit and now have a whole new host rock to explore.”

The latest drilling also confirmed that the dolerite / gabbro unit north of Glencoe contains gold-bearing quartz veins. Notable drilling impacts included 1 m at 1.04 g / t gold from 75 m. Further follow-up drilling is planned in this area.

Fox said further drilling will be done at Glencoe in November and December as PNX seeks to expand the gold footprint and improve the level of confidence for parts of the current deposit in the category indicated.

Further RC drilling begins this week, with an additional 1,000m to complete before PNX moves to drill three diamond holes in early 2022.

Three approximately 360m diamond drill holes are also planned as part of the ongoing drilling program and are expected to begin next month, subject to weather conditions and access during the NT wet season.

Geological mapping and sampling continued at Glencoe and Fountain Head, which will help improve confidence in geological models and exploration near the mine. Forty-nine surface samples have been submitted for analysis, with results expected early next month.

Environmental studies, including flora and fauna surveys and water sampling, are also underway alongside ongoing exploration activities.

Towards gold production

“Glencoe is an important part of our development plans for the Fountain Head gold and Hayes Creek gold and silver zinc projects,” noted Fox.

Located approximately 170 km south of Darwin and 3 km north of PNX’s Fountain Head gold project, Glencoe represents a “lit†asset that has significantly expanded the proposed development of Fountain Head.

Fountain Head – which currently has a resource of 2.94 million tonnes at 1.7 g / t for 156,000 ounces of gold – could become a regional processing hub for mineral deposits in the Pine Creek area.

A Pre-Feasibility Study (PFS) on the Fountain Head and Hayes Creek gold-silver-zinc projects released in June found robust, multi-product, two-stage mining development that would have an initial lifespan year, a pre-tax net present value (NPV) of $ 171 million and a pre-tax internal rate of return (IRR) of 63%.

NPV and IRR are measures used to assess the profitability of a project – the more the number is greater than 0, the more profitable it will be.

This article was developed in conjunction with PNX Metals, a Stockhead advertiser at the time of publication.

This article is not advice on financial products. You should consider getting independent advice before making any financial decisions.