Naira continues freefall in official markets, but CBN gets dollar firepower to defend itself before it gets worse Nigeria news

- The rise in the price of oil, the success of the Eurobond, as well as the SDR credit of 3.5 billion dollars from the International Monetary Fund (IMF) have helped to increase Nigeria’s reserves.

- In fact, Nigeria’s reserves are expected to reach over 40 billion in the coming months when the CBN receives all the expected money.

- The increase in foreign reserves will come as a welcome boost for the CBN in its struggles to keep the Naira stable amid pressure from investors and Nigerians for foreign currencies.

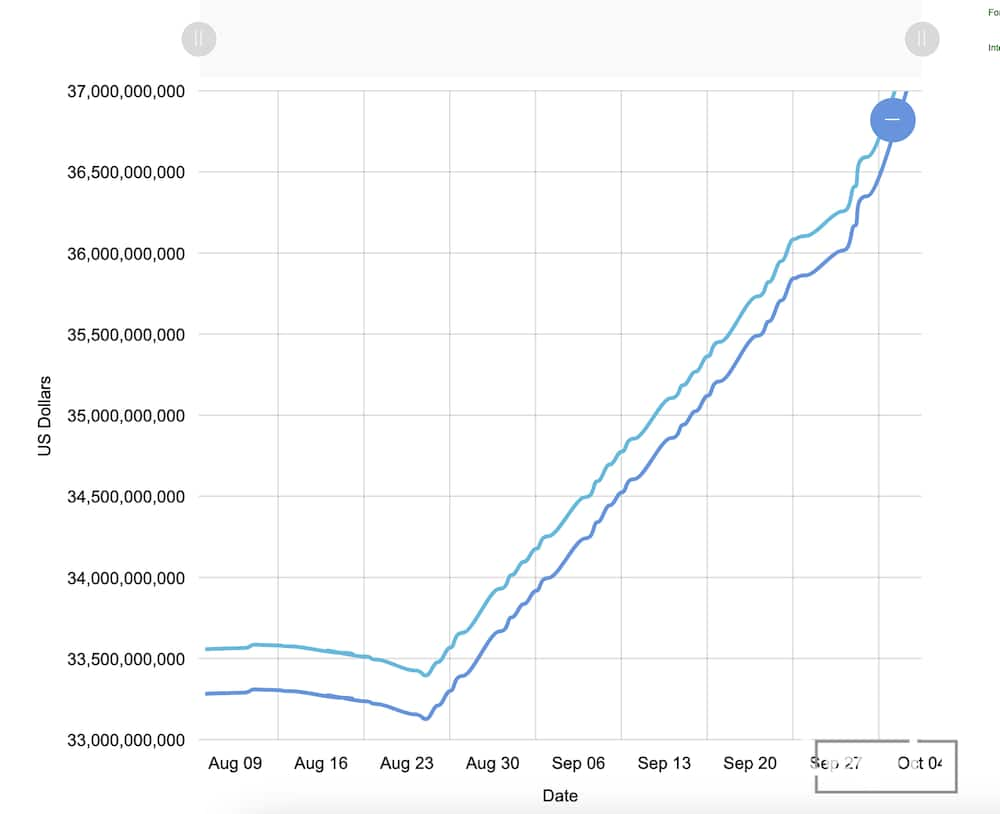

The Central Bank of Nigeria revealed that as of Wednesday, October 4, 2021, Nigeria had more than $ 37.56 billion in external reserves as of Tuesday, October 5, 2021.

This is the highest level of Nigeria’s foreign exchange reserves since Tuesday, February 2, 2020, when it stood at $ 36.6 billion.

In fact, the level of reserves on Tuesday, October 5, 2021 means that last month Nigerian savings increased by $ 2.70 billion.

Read also

Zuckerberg loses 2,4 trillion naira in 1 day amid global shutdown of Facebook, WhatsApp and Instagram services

Source: Origin

The increase in the country’s reserves comes amid rising oil prices in recent weeks and the recent success of the $ 4 billion Eurobond raised by the federal government on the international capital market (ICM).

PAY ATTENTION: Install our latest app for Android, read the best news on Nigeria’s # 1 news app

In fact, it is predicted that when Nigeria receives the expected $ 3.35 billion from the International Monetary Fund (IMF) $ 650 billion in Special Drawing Rights (SDRs), reserves will increase further to over $ 40 billion. dollars before the end of October.

Impact

The increase in foreign exchange reserves will come as a welcome boost for the Nigerian currency, which has been seriously battered both in the official market and in the black market.

Although the CBN has gone to great lengths to make black market rates inconsequential, pressure from businesses, investors, students, and parents for foreign currencies has created a window for black market traders. continue to profit.

Read also

Old receipt showing 40 bags of cement at N1520 sparks reactions from Nigerians online

Legit.ng A quick check of the latest official FMDQ securities exchange rate shows that at the close of Tuesday, October 5, 2021, the value of the naira has fallen to N414.30 / $ 1.

When you compared the closing exchange rate quoted on Tuesday to the N381 / $ 1 in early April 2021, it means that the Naira has devalued by a whopping N33.3 against the US dollar in 5 months.

With CBN having enough dollars to meet demand in the country, not only will the black market become more and more irrelevant, but also Naira might somehow find a reasonable level in the official market against the US dollar.

Ex-CBN chief criticizes Emefiele’s decision to ban BDC operators from selling forex

Meanwhile, Obadiah Mailafia, former vice-governor of the Central Bank of Nigeria (CBN), criticized the umbrella bank’s decision to stop providing foreign exchange to bureau de change operators.

Read also

FG’s essential trap for 3,964 Nigerians wanted and 6 major articles in the press review

Mailafia said the move could weaken the value of the naira against the dollar and other foreign currencies, as there could be a currency shortage.

Based on its experience with the banking system in Nigeria, Mailafia said banks could accumulate currencies for themselves and sell at a high cost to buyers whenever lenders want.

Source: legitimate Nigeria