Ur-Energy Stock Looks Expensive Despite Lost Creek’s Higher NPV (NYSE:URG)

kasezo/iStock via Getty Images

Introduction

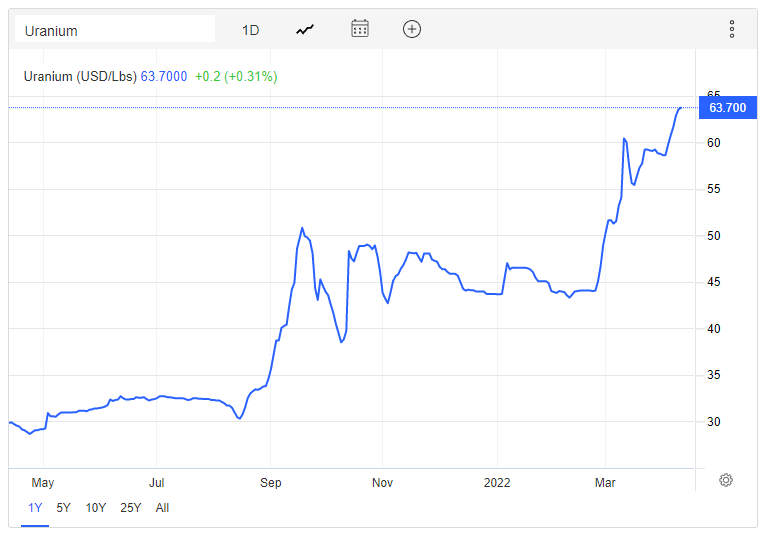

It’s been a crazy year for uranium prices, as the world is in the midst of an energy shortage and prices have more than doubled since August.

Trade economy

In view of this, I think it’s a good time to take a look at what’s going on at Ur-Energy (NYSE: URG). The company says on its website that it is the cheapest uranium producer in North America and the last time I covered it on SA was May 2021.

Over the past year, Ur-Energy has strengthened its balance sheet and taken steps to prepare its Lost Creek project for a rapid restart. The property’s NPV has improved significantly thanks to high uranium prices, but Ur-Energy seems expensive at the moment. Let’s review.

Overview of recent developments

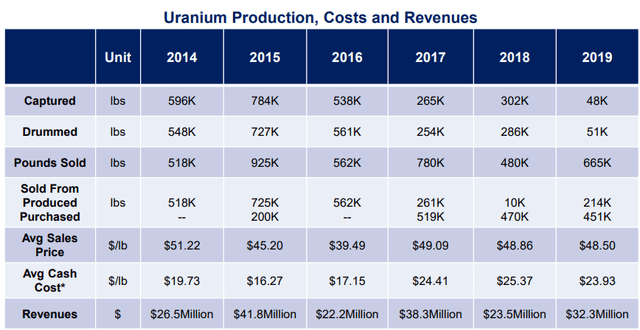

In case you haven’t read my earlier article on Ur-Energy, the company’s main project is the Lost Creek In Situ Uranium Recovery (ISR) facility in Wyoming, which has two mining units and measured and indicated resources of 11.9 million. pounds at an average grade of 0.046%. Yes, the ratings are very low, but it is suitable for an SRI project because these generally have low production costs. Between 2013 and 2020, Ur-Energy sold a total of 2.4 million pounds of uranium from Lost Creek along with 1.8 million pounds of purchased product. As you can see in the chart below, average cash costs ranged from $16.27 per pound to $25.37 when Lost Creek was in operation.

Ur-Energy

As for Ur-Energy’s other assets, the company owns the Shirley Basin ISR uranium project in Wyoming, which has so far produced more than 28 million pounds. The property currently has measured and indicated resources of 8.8 million pounds at an average grade of 0.23% and the company says production costs are estimated at $15.86 per pound. Ur-Energy also holds an inventory of approximately 284,000 pounds of uranium valued at $18.09 million at current spot prices. As of March 3, the company’s cash position was $44.7 million.

So what has Ur-Energy been up to lately? Well, the company raised $55.2 million through capital raises in 2021 and October 2021. he initiated a development program at Lost Creek which includes a drilling and construction program for the development of the fourth headhouse at the project’s second mining unit. This is expected to be completed in the second quarter of 2022, when the second mining unit will be ready for production. Ur-Energy then plans to initiate a delineation drilling program, which will enable the development and construction of the next four head houses in the second mining unit. These initiatives aim to shorten the time needed to restart production and Ur-Energy estimates that operations can reach full production rates in as little as nine months once it has made the decision to return to the market. Unfortunately, Ur-Energy did not specify at what uranium price level it is ready to restart production. Optimistically, the company could be operating at full capacity in early 2023, but the problem is that it does not have long-term contracts for the sale of its uranium, which is usually a prerequisite for starting up. a mine in this space.

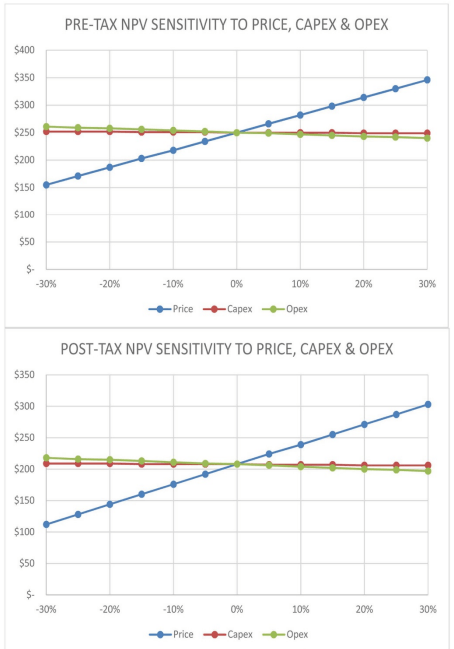

Overall, I consider Lost Creek to be a relatively small uranium project as it currently has a licensed annual production plant of 2.2 million pounds of uranium, which includes up to 1 shaft production, 2 million pounds and uranium and custom processing of up to 1 million pounds of uranium. uranium. If you exclude toll processing, the project can generate revenues of only $76.4 million per year at today’s spot prices and the mine life is approximately 8 years. However, the net present value (NPV) is starting to look compelling given today’s uranium spot prices, as production costs are low. The last Preliminary Economic Assessment (PEA) for Lost Creek was completed in 2016 and was based on life-of-mine uranium prices of $66.03. The after-tax NPV was just above $200 million.

Ur-Energy

According to a 2015 PEA, Shirley Basin has an NPV of $146 million at $65.29 per pound of uranium over the life of mine. However, this mine is not about to resume production and Ur-Energy has a market valuation of $384.4 million at the time of writing. Excluding the $62.8 million the company holds in cash and uranium inventory, we are left with $321.6 million, or about 60% more than Lost Creek’s current after-tax NPV. For Ur-Energy to trade at around 1x the NPV, uranium prices would need to rise to over $85 per pound.

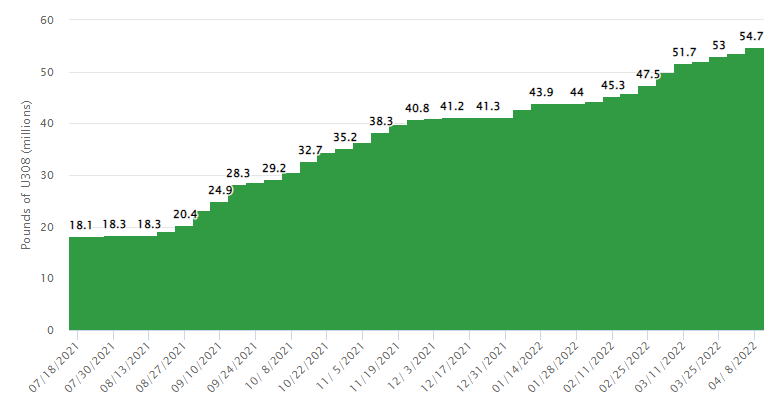

Overall, I think Ur-Energy’s project economics look much better today than a year ago thanks to high uranium prices. However, the company’s price is perfect at the moment and that’s why I’m bearish. That being said, opening a short position looks dangerous at the moment as I think uranium prices are likely to continue to rise in the near future. In my view, the market is being squeezed by Sprott Physical Uranium Trust (OTCPK:SRUUF), which I’ve covered here. Current annual worldwide consumption of uranium is approximately 190 million pounds and this trust alone has purchased 36.4 million pounds since mid-August 2021.

Sprott Physical Uranium Trust

Whereas the trust has a $3.5 billion market action program, it could be a long time before uranium prices stop rising.

Takeaway for investors

Uranium prices have increased significantly over the past few months, which has improved Lost Creek’s NPV. I think the news of a production restart is likely to give a significant boost to Ur-Energy stock prices.

However, this project is worth approximately $200 million at today’s uranium spot prices, which is well below the market valuation of Ur-Energy. Still, I think investors should avoid shorting these stocks because uranium prices may continue to rise for some time due to the pressure that Sprott Physical Uranium Trust is currently putting on the market. If you are considering using a strange options strategy to take advantage of stock price volatility, no options are currently available for Ur-Energy. I think this stock is best avoided for now.