A crisis is coming – 4 steps to meet Africa’s urgent financing needs

African countries are facing a wave of crises and need to adapt quickly. COVID-19, weather disruption, conflict and Russia’s war in Ukraine are causing severe setbacks in food, fuel, debt and liquidity, with no signs of slowing down.

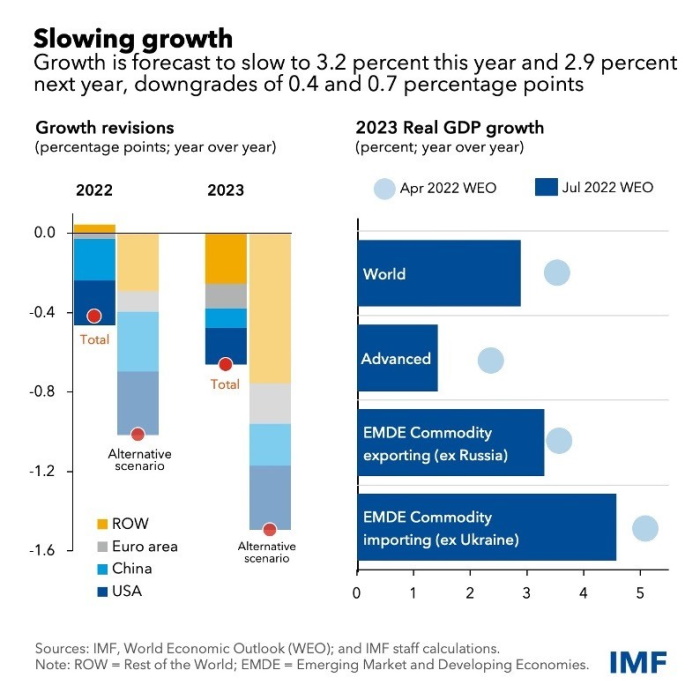

The World Bank’s June 2022 Global Economic Prospects (GEP) report predicted that the global economy was heading into years of weak growth and rising prices, with potentially destabilizing consequences for low- and middle-income economies. . With these multiple crises intensifying, the IMF’s Kristalina Georgieva warned at the recent G20 conference that the global economic outlook “has darkened significantly”. A period of prolonged global stagflation is likely and African countries are at risk.

A period of prolonged global stagflation is likely and African countries are at risk. Image: International Monetary Fund

Africa’s urgent call for financial reform

Alarmingly, the global financial architecture, designed more than 50 years ago, is no longer fit for purpose. She, above all, has let Africa down. A crisis is approaching and many African countries are taking steps to try to protect themselves against this emerging threat.

As African leaders actively try to protect their economies, global power brokers and politicians must also play their part and urgently reform the global financial architecture. As the world emerges from the economic shocks of COVID-19, near-term needs should not overshadow the urgency of fixing a broken global system. If no action is taken to protect Africa, the costs of inaction and resulting injustice will be global.

African leaders, stepping up and taking action, are calling for an urgent restructuring of the global financial architecture, outlining the reforms needed to ensure a faster and more stable global recovery.

“Inaction is not an option for Africa or the world. The spread of social unrest, over-indebtedness and protracted political crises on the continent will have global ramifications,” said KY Amoako, Founder and Chairman of the African Center for Economic Transformation (ACET), at a recent Transformation Leadership meeting. Panel, a body of world leaders chaired by Ellen Johnson Sirleaf and coordinated by ACET.

Vera Songwe, TLP Fellow and Executive Secretary of the United Nations Economic Commission for Africa, added, “This is not just a crisis where the poor are getting poorer. Rising costs are hitting the African middle class hard. In Nigeria, fuel prices are so high that people cannot afford to drive to work.

Masood Ahmed, a member of the TLP and president of the Center for Global Development, echoed the urgency of the situation, saying that “the multiple crises currently affecting African countries, including over-indebtedness and the real possibility that countries failure, will have serious internal and external consequences. political consequences. We need to instill a greater sense of urgency and greater awareness of the realities facing African countries.

In order to avert catastrophe, we have identified four steps on how to reform the global financial architecture to better serve Africa:

Step 1: Ensure equitable distribution of special drawing rights

African countries urgently need new liquidity, which the IMF’s Special Drawing Rights (SDRs) can provide quickly. The SDR is not a currency. It is a potential claim on the freely usable currencies of IMF members, which can provide liquidity to a country. This cash is essential to help African governments set up and maintain basic social protection programs in the face of drastic increases in food and fuel prices.

However, of the initial allocation of $650 billion in SDRs in August last year, only $33 billion – barely 5% – was allocated to Africa. More than a year ago, when the crisis was less severe, world leaders recognized the need to channel more SDRs to African governments. The need for a fair and efficient process for the allocation of SDRs is now more urgent than ever.

African leaders called on the IMF to first accelerate the implementation of SDR reallocation mechanisms aligned with the needs of African economies. They also called for the development of more appropriate award criteria. This would mean issuing new rights as well as re-attribution. Some of these additional special drawing rights should be channeled through regional development banks, such as the African Development Bank.

Step 2: Fix broken debt management machinery

At the end of May 2022, 23 African countries were at high risk – or already in – debt distress. The situation is getting worse with rising interest rates and Russia’s war in Ukraine. Debt relief must be prompt, comprehensive and substantial.

To facilitate debt restructuring, the G20 called on creditors to come together within a common framework. Progress has been painfully slow, but last week exciting news from Zambia finally benefited from this framework, paving the way for an IMF program in the country. African leaders are calling for improved multilateral debt restructuring frameworks to reposition debt as a catalyst for economic recovery and sustainable growth. Workable solutions are needed to ensure access to finance at competitive and non-punitive rates.

Step 3: Scale up Africa’s climate finance to drive global solutions

Although Africa contributed only 3.8% of global emissions, it bore the brunt of climate change. Each year, Africa loses between $7 billion and $15 billion due to climate change, and this figure is expected to reach $50 billion by 2040. The lack of climate finance, the cost of climate finance not provided and the neglected carbon market now demand urgent attention in Africa. .

At the same time, the opportunities for Africa to lead a green transformation are plentiful. For example, market mechanisms that reward Africa for its carbon sequestration can be developed, making finance available for the continent’s green transformation. Ibrahim Mayaki, TLP panel member and former CEO of AUDA-NEPAD, highlighted the importance of scaling up climate action in Africa through carbon mitigation, job creation and agricultural transformation while “offering much-needed climate solutions to the planet”. ”

Step 4: Rebuild trust and create a new global partnership for Africa

It is a critical year. Africa’s collective voice and positions must be loud and clear on key global decision-making platforms. Ahead of the IMF and World Bank annual meetings in October and COP27 in November, a coalition to build consensus, galvanize action and rally support for Africa’s unified positions should be encouraged. Not only will such action ultimately lead to reforms in the global financial architecture to better serve Africa, but it will also provide an opportunity to restore and rebuild confidence in international dialogue and action.

As the global financial architecture faces inclusive, effective and equitable reforms, African countries need to be better represented and have a stronger voice in the governance bodies of key global institutions, including the Bretton Wood institutions. Africa can then be a continent that actively contributes to the design of global solutions rather than suffering from their absence.

Source: World Economic Forum