Indonesia Energy undervalued due to higher oil prices (NYSE:INDO)

asbe/iStock via Getty Images

Indonesia Energy Corporation Limited (INDO) is ramping up after management reported new information on the drilling process in the Kruh Block. In addition, the recent increase in the price of crude oil is moving the market. I counted the total crude oil production from the Kruh Block and I think the company could be worth over $380 million. If we also assume the exploration of the Citarum block and the Rangkas area, the valuation could be even higher.

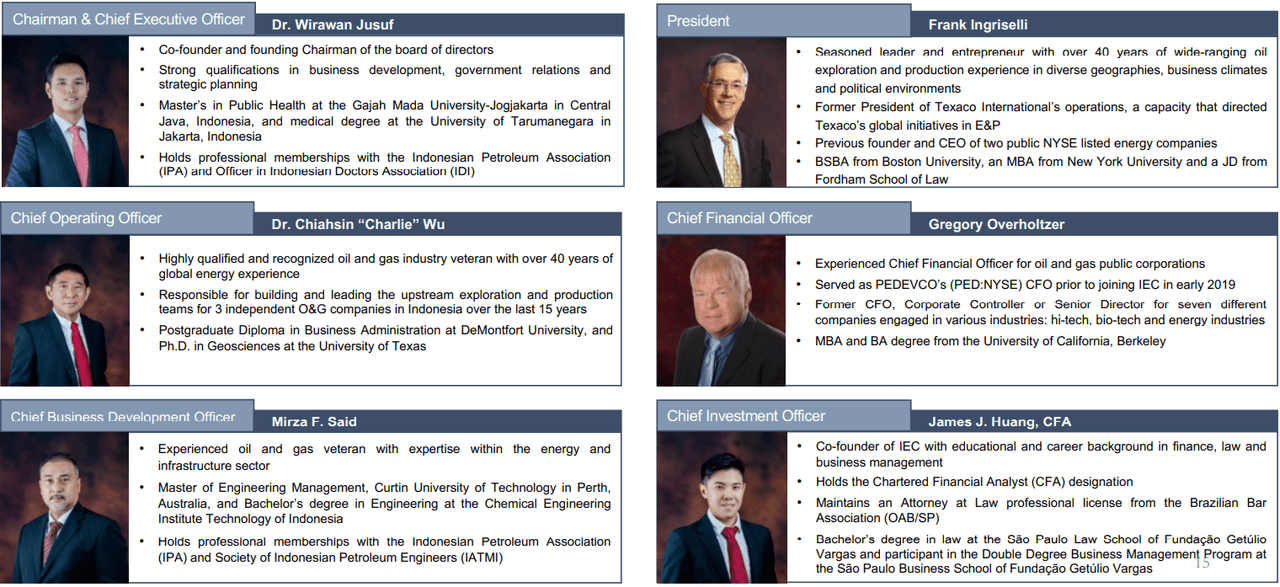

Indonesia Energy Corporation: Current Team and Block Kruh Can Explain Recent Share Price Rise

Indonesia Energy Corporation is an oil and gas exploration and production company with an outstanding team of major players in the United States.

Among the members of the board of directors and management, I would highlight the profile of the president, who is a former president of Texaco. Another well-known veteran is the CFO, who was also the CFO of Pedevco (PED). I decided to lead business research after team review. Readers may wish to do the same:

Investor Presentation January 2022

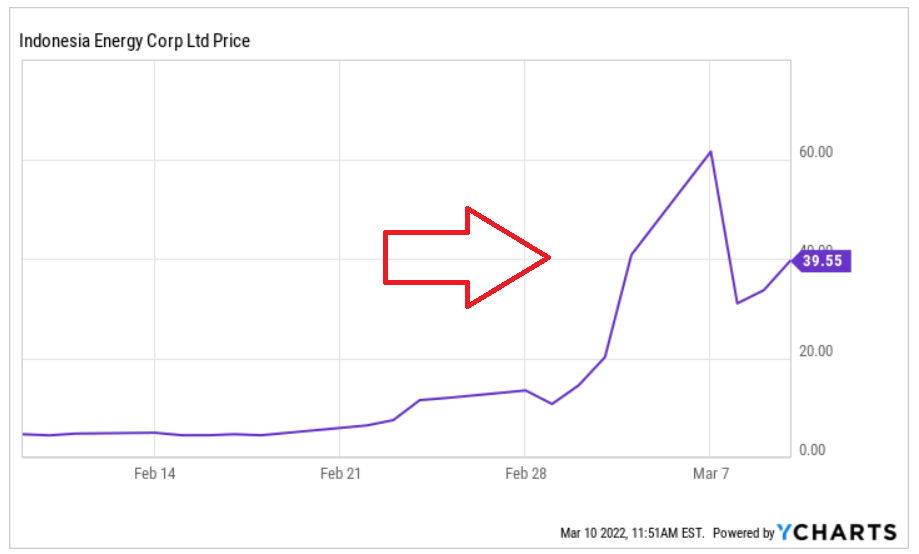

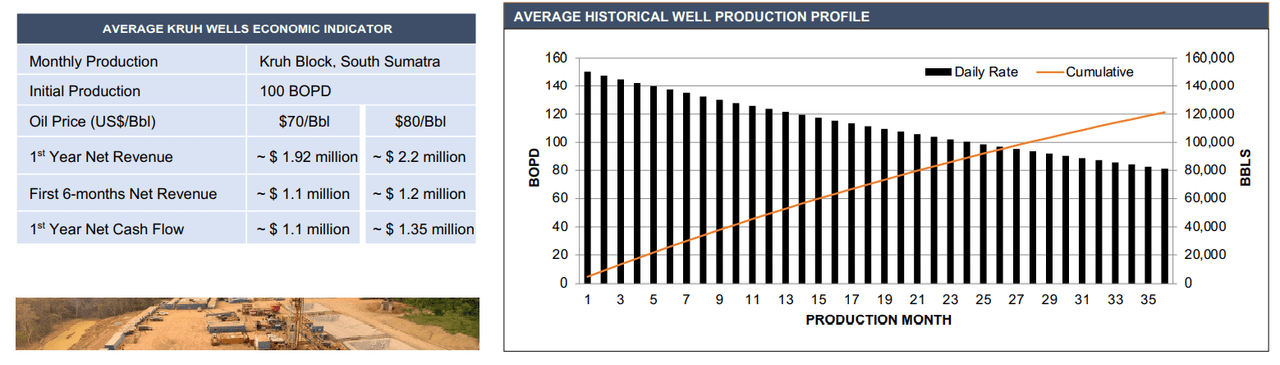

With the team, the reason as to why the current valuation is at its maximum level comes from several figures delivered very recently. As of March 10, 2020, management has advised that it has successfully mobilized the rig to drill 2 consecutive producing wells. Additionally, management expects each well to generate $2.6 million in net revenue in its first twelve months:

Indonesia Energy Corporation announced that the company has mobilized the drilling rig to drill 2 consecutive production wells in its 63,000 acre Kruh block. Based on the terms of IEC’s contract with the Indonesian government and an oil price of $95.00/barrel (15% below yesterday’s closing price for Brent), each well should generate $2.6 million in net revenue in its first twelve months, which is enough to recoup the cost of drilling the wells in the first year of production. Source: Indonesia Energy mobilizes drilling rig to start

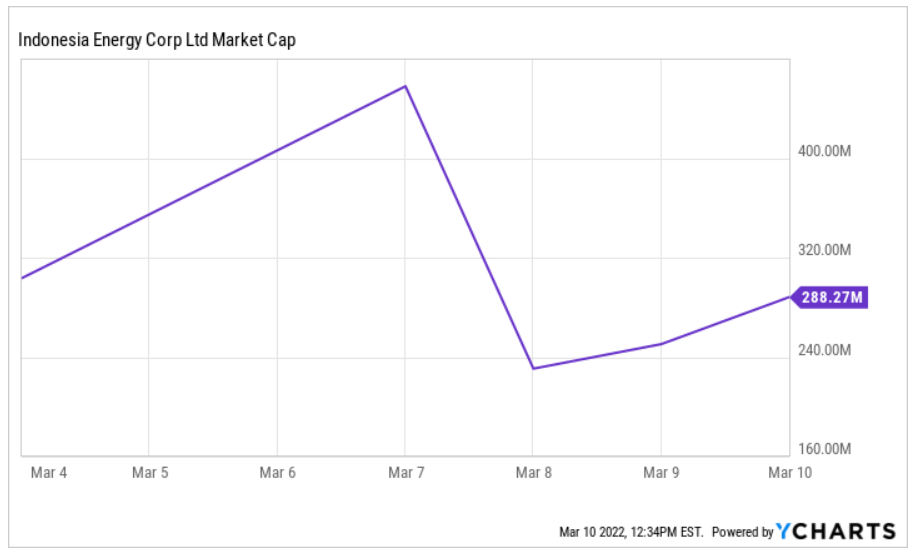

Y-Charts

I was very interested in the new information and the recent massive increase in stock prices. I decided to assess the valuation and potential production of Indonesia Energy’s Kruh block.

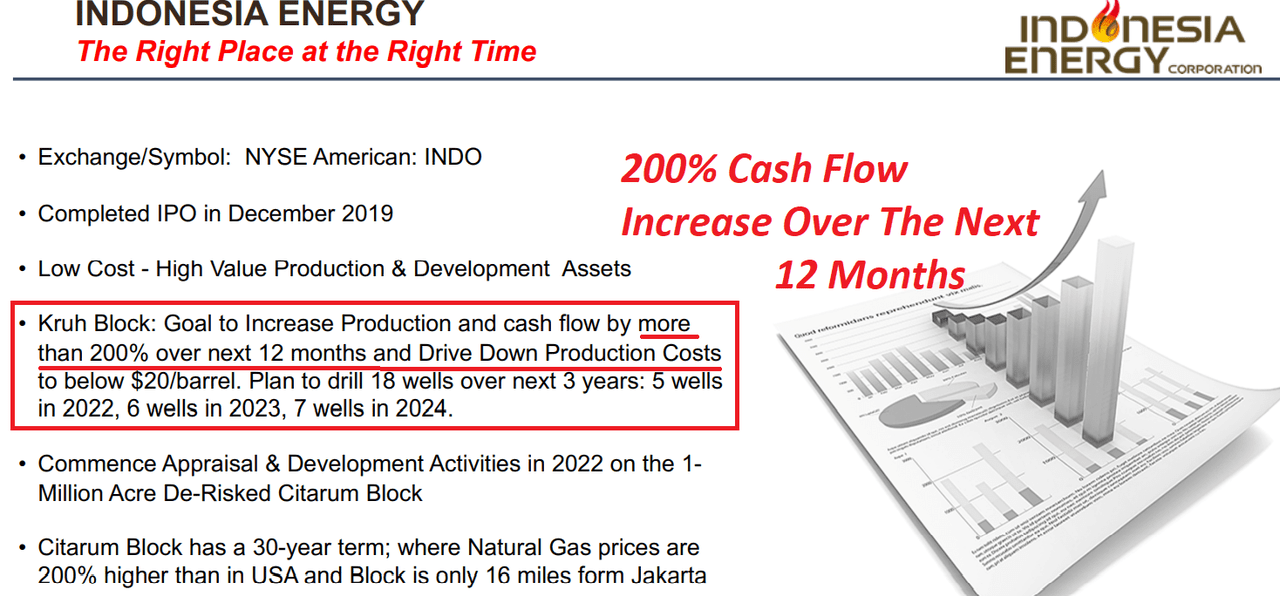

Kruh block’s net present value could reach $380 million

In order to assess the valuation of Kruh Block, I have noted certain assumptions made by management. First, the company estimates that production could increase enough to generate a cash flow increase of more than 200% y/y:

Investor Presentation January 2022

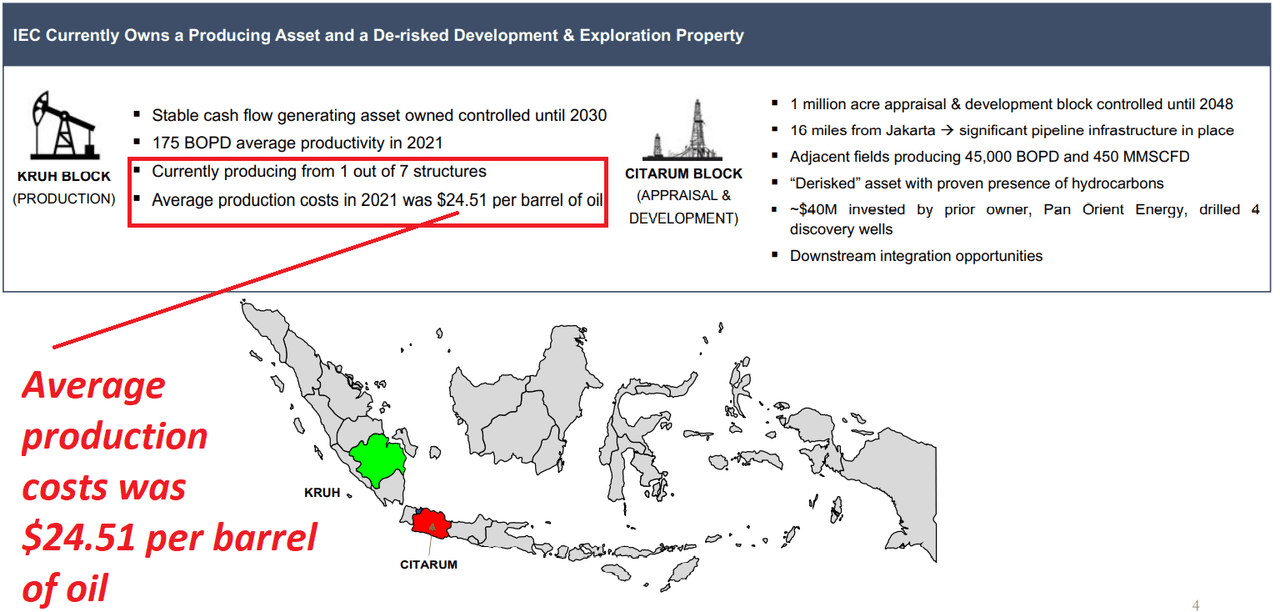

Another critical piece of information I got during a recent investor presentation is the fact that management is working with an average production cost of $24.51 per barrel. The figure may be a bit old as economies of scale may apply. With that, I’ll use this financial number because it’s the only indication of cost per barrel that I could find:

Investor Presentation January 2022

From the company’s website, I got a combined proven developed and undeveloped crude oil reserves of 4.99 million barrels. I also assumed that the company could produce over 9,900 barrels of oil per month. This means that we would be talking about almost 0.119 million barrels per year:

Kruh Block covers an area of 258 square kilometers (63,753 acres) in Sumatra, Indonesia. This block was producing an average of about 9,900 barrels of oil per month. Source: Company Website

Of the eight proven and potentially oil-bearing structures in the block, three structures (North Kruh, Kruh and West Kruh fields) have combined developed and undeveloped proven crude oil reserves of 4.99 million barrels. Source: company website

Investor Presentation January 2022

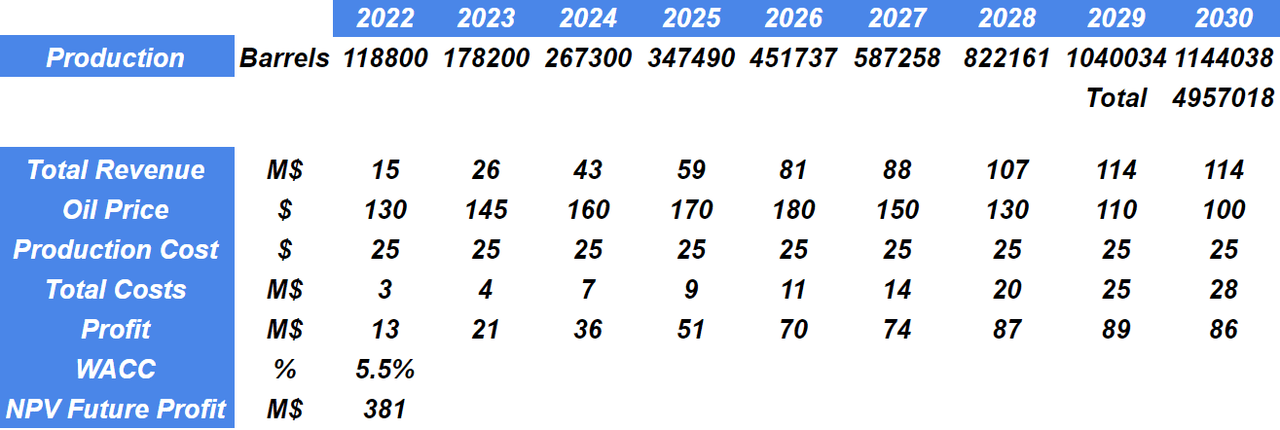

I used previous information and assumed that the block will operate until 2030. I also assumed that the price of oil will go from $130 in 2022 to $40 in 2032. With production per barrel at $25 and a 5% WACC, I got a total net present value close to $380 million. Therefore, I think there may be even more upside potential in the stock price:

Qingshan Capital Management Y-Charts

Market cap could rise further thanks to Citarum exploration block and Rangkas area

I believe we can see increases in market capitalization if Indonesia Energy does relevant exploration work in the Citarum block and the Rangkas area. The team that leads Indonesia Energy is exceptional and demonstrates great expertise and know-how acquired from large companies in the United States. So I’m pretty optimistic about the company’s exploration activities:

We currently have rights through contracts with the Indonesian government to an oil and gas production block (called the Kruh block) and an oil and gas exploration block (called the Citarum block). We have also identified a third potential exploration block, known as the Rangkas area, and may seek to acquire or otherwise obtain rights to additional oil and gas producing assets. Source: Operating review for the six months ended June 30, 2021

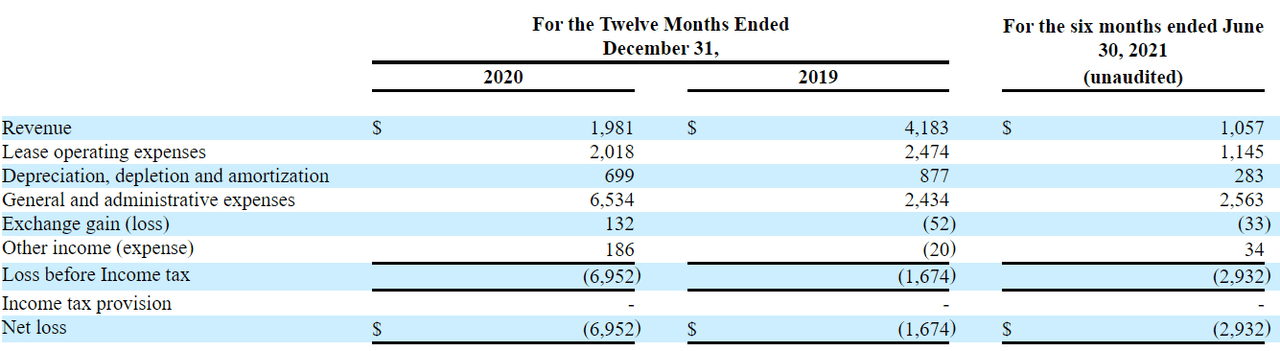

High expectations and the income statement indicate that expenses are increasing at a steady pace

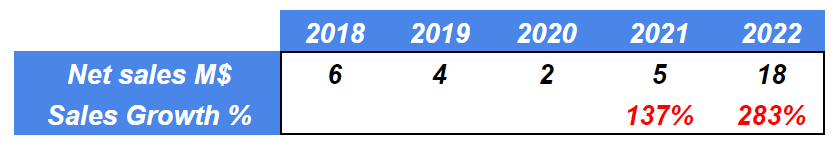

Most analysts expecting triple digit sales growth in 2022, I don’t think going back to what happened in the past is very relevant. With that, I should note one thing about the total expenses reported by Indonesian Energy:

market analyst

In the last prospectus, INDO reported a significant increase in the total amount of general and administrative expenses. In my opinion, this is an excellent signal. More spending means INDO explores more and pays more personnel for oil production. As a result, I think revenue growth is likely to accelerate as well:

Operating review for the six months ended June 30, 2021

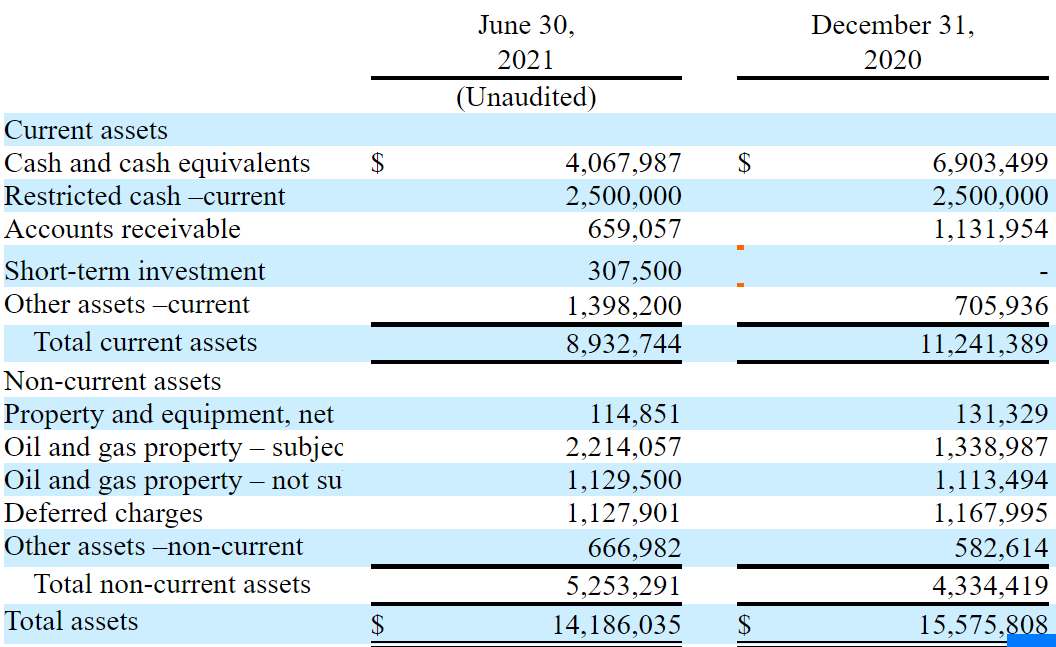

Balance sheet

INDO’s balance sheet looks healthy with an asset/liability ratio of 3.7x. Cash in hand also represents 45% of the total amount of assets, so that the company has cash to invest in capital expenditures in the years to come. Interestingly, oil and gas properties increased a little in 2021:

F-1

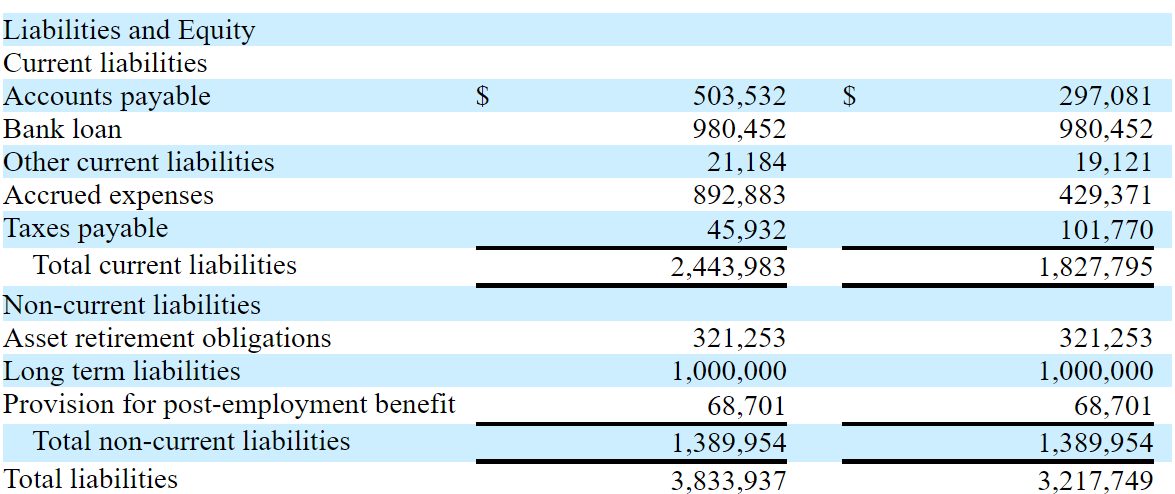

I am not concerned about the total amount of INDO’s debt. I’ve only seen one bank loan worth less than $1 million, which is significantly less than the current amount of cash available:

F-1

Risk related to the geographical concentration of exploration and production as well as supply contracts in Indonesia

The company highlighted the fact that it is mainly based in Indonesia. If something very relevant happens in the country, the income line may drop. In my opinion, if management really wants to receive investment, it will have to diversify its exploration efforts a little more:

Our business is focused on oil and gas exploration in limited areas in Indonesia and exploitation of all significant reserves that are within our license areas. Consequently, we lack diversification, both in the nature and in the geographic scope of our activities. We are likely to be more affected by factors affecting our industry or the regions in which we operate than we would be if our businesses were more diversified. If we fail to diversify our business, our financial condition and results of operations could deteriorate. Source: F-1

The INDO will have to trade under a jurisdiction very different from that of the United States, which represents a significant risk. As part of the agreements that INDO will have to sign, there is the take-or-pay arrangement, which could cause the company to lose a significant amount of money:

The common term in gas supply contracts is a “firm purchase agreement” in which the buyer is obliged either to pay the price corresponding to certain quantities of natural gas agreed in advance and to take off these quantities, or to pay their corresponding price, that he buys them. Under certain circumstances, such as an industrial or economic crisis in Indonesia or around the world, the buyer may be unwilling or unable to make these payments, which could trigger a renegotiation of contracts and make the disputed between the parties. Source: F-1

Without sufficient funding, INDO may not be able to fund CapEx, which could reduce planned production

If INDO raises less capital than expected, the company’s expected production numbers could be lower than originally forecast. If analysts notice that the company will not provide expected cash flow, investors may sell their holdings, which may cause the stock price to fall. I would say that the company might not even touch INDO’s cash per share:

We cannot assure you that we will have sufficient capital resources in the future to fund all of our planned capital expenditures. This is especially the case as we raised less than expected in our December 2019 IPO, which forced us to modify our drilling plans and other operational plans in 2020 and 2021. Source: F-1

Conclusion

INDO benefits from rising crude oil prices. In my opinion, the market is very fond of the team of professionals inside the organization. With the new information on the drilling of the INDO producing block, I believe the NPV of this asset could be worth $380 million. But that’s not all. If management also succeeds in exploring the Citarum block and the Rangkas area, the total valuation could be even higher. Yes, there are also risks. In fact, I’ll follow INDO anyway.