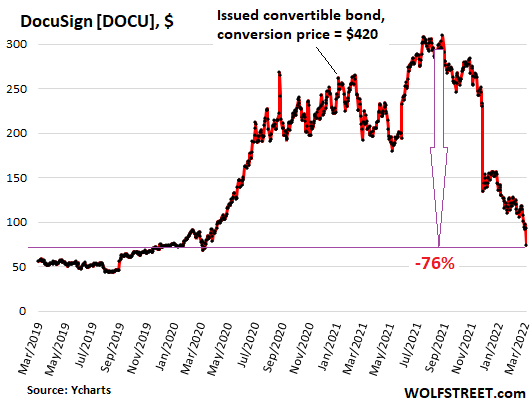

DocuSign shows how gigantic blind madness was and how it suddenly went crazy

And then there were the rabid convertible bonds with a conversion price of $420, hahaha.

By Wolf Richter for WOLF STREET.

It’s amazing – I mean, not really if you’ve been through the dotcom bust – and brutal how these hype-and-hoopla stocks of money-losing companies are now being dropped and pulled off the back and shot, a by one, after they had gone from already high levels to ridiculous levels starting in March 2020, when the Fed began throwing what would become $4.7 trillion into the markets.

The companies are still the same companies that were losing money as before. There was never any logical or fundamental reason for these stocks to jump from already high levels to these ridiculous levels. It was just raging stock market madness, fueled by reckless cash draws and, as we’ve seen, stimulus checks that went straight to the stock market.

But now those stocks are going to hell, even if it’s not a straight line – and it has nothing to do with Ukraine. And whoever ended up buying them directly or indirectly after they were whipped to ridiculous levels just transferred their wealth to whoever was selling that stuff.

So today is DocuSign again.

I say “again” because a quarter of an hour ago, after the company reported earnings, shares crashed 30% in after-hours trading and 41% the next day in regular exchanges. In dollar terms, it was a huge drop, from $231 per share to $135 per share.

The dip buyers arrived – the stocks were “on sale” and “40% off”, or whatever and it was just unstoppable – but the bounce was small and quickly turned into a slide, going lower and lower, interrupted by futile declines. purchase.

Last night DocuSign released another revenue report. At the pre-release close, shares were at $93.88. And oops. In regular trading today, shares plunged 20% to $75.01, down from where they were at the March 20, 2020 crash low, and back to where they first were. times in December 2019 (the company’s IPO was in April 2018). They are down 76% from the August 2021 high (more on this convertible bond offering in a moment):

But $75 per share is still ridiculously high.

This gives the company a market value of almost $15 billion – more than Seven times its annual sales in 2022 of $2.1 billion. And it’s a company with a perfect six-year streak of annual losses, amounting to $1.12 billion, including the loss it announced last night for 2022 of $70 million.

To cover its net losses, as reported under GAAP, it still touts fake non-GAAP earnings made up of its own measures, including fake non-GAAP earnings per share.

This toxic mix of real losses, for a company that has been around for years and has $2.1 billion in revenue, and fake non-GAAP earnings should instantly turn off every investor.

But that’s not the case, apparently. What discouraged investors was slower “billing” growth and slower-than-expected revenue forecasts.

The 40% crash last December was triggered when third-quarter billings slowed to 28% year-over-year.

In the fourth quarter, announced last night, this billing growth had fallen to 25%. And in its first-quarter guidance, the company projects billing growth of 9% to 11% year-over-year.

If you’ve signed contracts electronically in the past few years, you’ve used DocuSign or a competitor. The meme to stoke the ridiculous stock price movement from March 2020 was that now everyone and their dog would sign all contracts electronically through DocuSign, and even if that theory had worked, the stock price would still have been ridiculously overrated. But this theory did not work. There are other companies that offer electronic document signing, a system that has been around for many years.

It turns out that DocuSign is not a miracle company that runs on water, but a normal company with decent revenue growth and a product that, like most products, is being chased by competitors. And it’s a company that still loses a ton of money. So how much is a business like this worth? That’s the question we keep answering as the stock plummets.

Raging-mania convertible bonds at $420 per share, hahahaha

DocuSign has also accumulated debt, including convertible bonds. It issued the most recent, a $600 million three-year bond, on Jan. 13, 2021, as its shares still climbed higher and higher and only the sky was the limit.

At the time of the bond offering, the stock price was $262.65. The agreement was that each bond (face value = $1,000) could be converted into 2.38 shares on January 15, 2024, when the bond matured – thus at a conversion price of $420.

The bond pays no interest. Investors loaned that money to the company in hopes of being able to convert the bond into shares that would hopefully be well above $420.

If the shares are below $420 when the bond matures, bondholders would receive the face value of the bond, with no gain or interest for three years. It is therefore not a disaster for bondholders.

But what these numbers show is that the market expected DocuSign to trade at over $420 per share by January 2024, a totally ridiculous price that was considered realistic at the start of 2021. This What these numbers show is that the market had become a gigantic fed-fed blind madness where no one could have a single clear thought and money no longer mattered. And the hangover of this unleashed mania is now being felt in these fashionable actions.

Do you like to read WOLF STREET and want to support it? You use ad blockers – I completely understand why – but you want to support the site? You can donate. I greatly appreciate it. Click on the mug of beer and iced tea to find out how:

Would you like to be notified by e-mail when WOLF STREET publishes a new article? Register here.

![]()